Can technology offer the much-needed route to decarbonise our economies?

Ambitions and commitments to cut carbon emissions to achieve net-zero goals have proliferated over the last 5 years. However, as countries and companies start to put into place transition plans to achieve these ambitions, there is a growing realisation that the challenges to meet targets and goals are huge.

Could technology be the saviour and provide the transformative solutions that are now required to be able to take critical industries from a highly carbon intensive path to one that will be aligned with net zero?

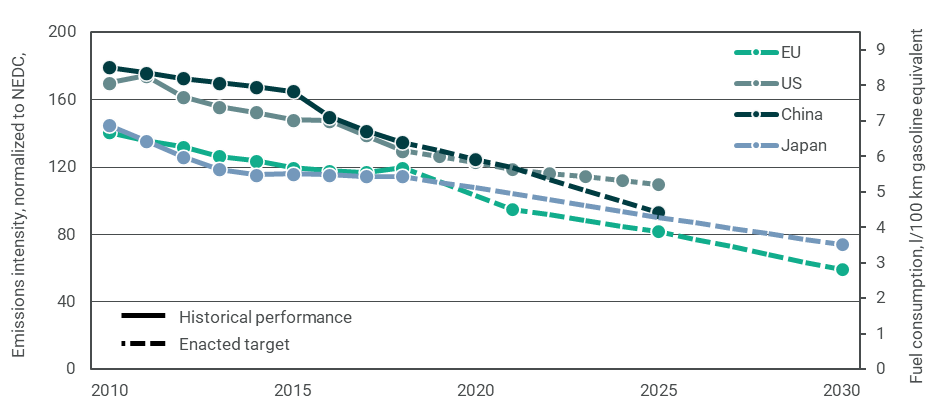

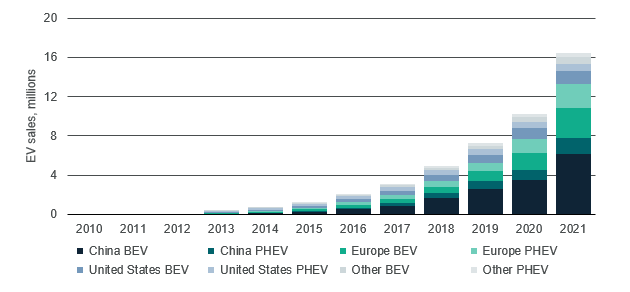

Technology has been the main driver in disrupting and changing the automotive industry. Battery electric vehicle (BEV) technology developed by Tesla, a new entrant, is enabling a shift from the internal combustion engine, a technology in place for decades, into a new power train based on electricity. This offers a clear path to decarbonisation for the automotive sector. Regulators are now positioned to accelerate this shift; fleet emissions intensity regulation in all four major markets is stepping up to push the incumbent auto makers towards electrified fleets. Chinese regulation has been particularly successful in adopting a mixture of technology incentives for automakers to shift into new EVs while at the same time achieving fleet emissions intensity targets. This has created a new group of Chinese automakers with BEV models that will see demand not just in China but across all car markets, disrupting the status quo, with the European car market most open for change.

Figure 1. Regulatory targets for fleet emissions intensity (based on the New European Driving Cycle procedure).

Source: IEA, Carbon Transition Analytics

Figure 2. Global electric car stock 2010-2021

Source: IEA, Carbon Transition Analytics

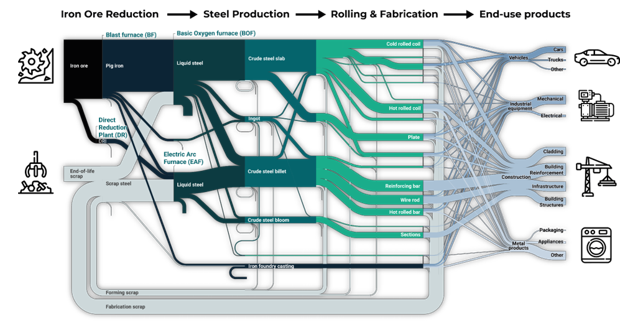

Even sectors such as steel, which used to be in the hard-to-abate category and where steel producers have been locked-in to highly carbon intensive pathways, are finally seeing technology solutions. Steel companies now have the opportunity to switch out of the highly carbon intensive blast furnace and basic oxygen furnace route into the hydrogen direct reduction with electric arc furnaces route. While still not widely deployed outside of Europe, companies making asset decisions on new steel capacity in emerging markets now have near zero carbon technology alternatives. Companies making these decisions on long-lived assets should be making an informed choice on which technology to adopt, considering both short- and long-term costs, to avoid lock-in to highly carbon intensive pathways and potential asset write-downs.

The interconnectedness of supply chains should result in a spillover effect from technology. The steel sector is core to end markets such as autos and construction and a key part of the upstream supply chain for bulk commodities such as iron ore and coking coal. Shifts in supply and demand patterns in one sector can have profound changes for other sectors either directly or indirectly. This is evident in the automotive sector where auto companies are creating demand for green steel. Companies such as Volvo and BMW have signed offtake agreements for green steel from hydrogen-based direct reduced iron production from steel companies such as SSAB. This will help to partially de-risk the additional cost of this near zero carbon technology route to steel production and act as an incentive for further technology deployments.

Figure 3. The steel value chain

Source: UIT Cambridge, Carbon Transition Analytics

Technology shifts in autos and steel will continue to disrupt existing business models. We are already seeing changes in business models being adopted by automakers who are doing deals directly with mining companies for critical battery materials and mining companies moving down the supply chain by producing green sponge iron that can be fed into the hydrogen-based production for steel. Technology and new business models will hold the key to achieving the challenges to meet net-zero ambitions.

Carole Ferguson is the CEO of Carbon Transition Analytics – a research and analytics group focused on transition planning for high carbon intensive companies and sectors. Carbon transition analytics has done detailed research on transition planning for 29 global auto and 30 global steel companies.