Top trends in the mega cleantech boom

Any product or service that reduces negative environmental impacts through significant energy efficiency improvements, the sustainable use of resources, or environmental protection is known as clean energy technology or simply cleantech.

Back in 2006, venture capital firms had placed their bet on cleantech. They opined that the energy sector was ready for disruption. Indeed, that year, cleantech start-up companies attracted $1.75 billion from venture capitalists (VCs), far more than ever before. From 2006 to 2011, venture capital firms spent over $25 billion in the cleantech sector, funding technologies with positive environmental impacts. By 2011, they had lost over half their money. Their investments could rarely achieve manufacturing scale. New pro-environment technologies were being invented but were not breaking even in the market. There was also a lack of momentum among large companies to invest in the cleantech sector, making it a sector for small firms trying their luck. Less than 10% of cleantech companies founded after 2007 generated returns that matched even the initial capital. Cleantech therefore offered VCs a dismal risk-return and subsequently lost popularity.

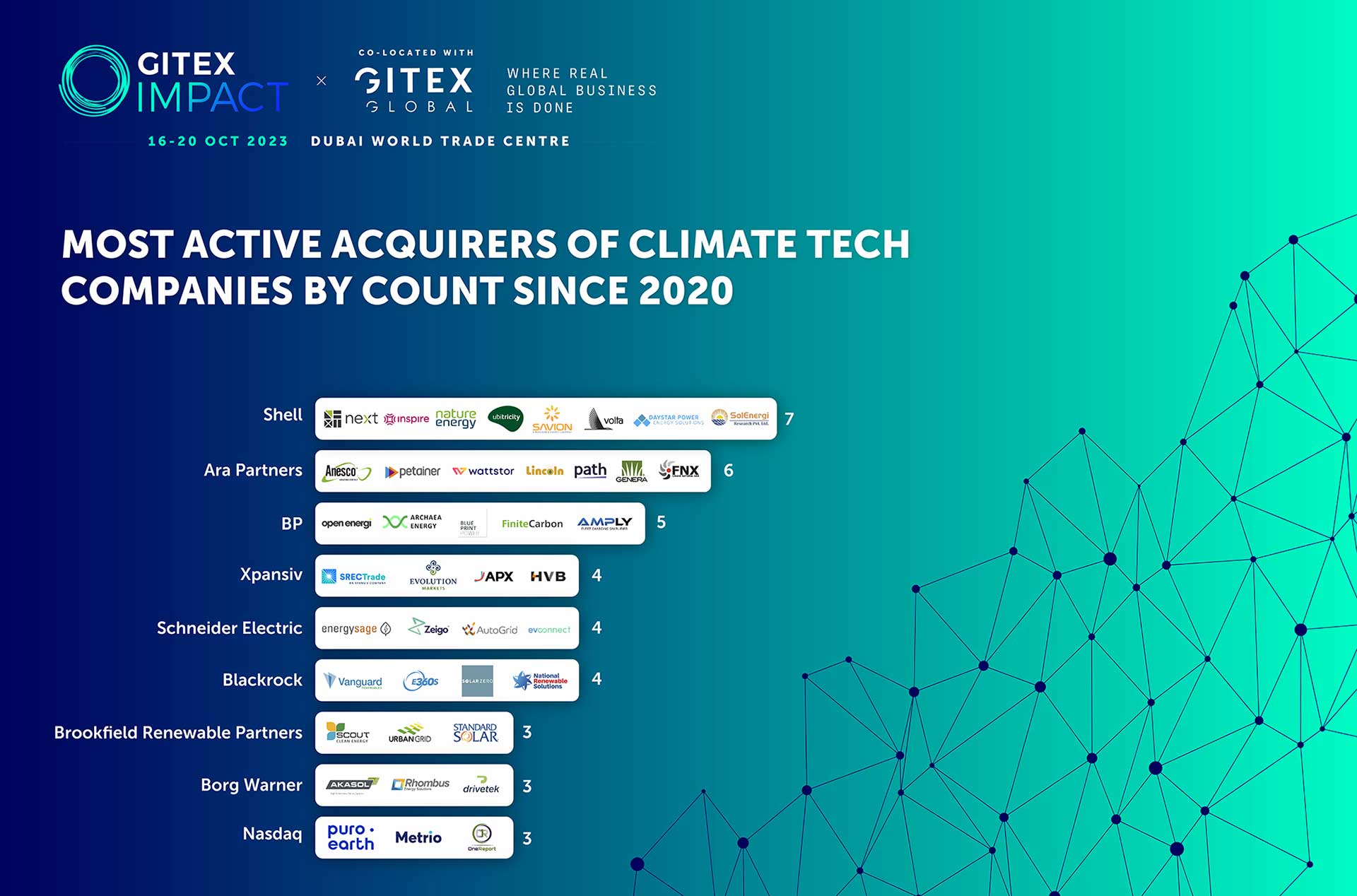

National-level commitments at the 2015 Paris Climate Change Summit paved the way for companies, large and small, innovating in cleantech. However, turnaround for the sector came about in 2020, by when there was new public and private capital coming in to the sector. It was clear that climate solutions depend on funds, skills, and technologies. On funds – climate solutions that were pre-dominantly funded by tax payer money began to attract billions of dollars in investments and funds. On skills – top universities including Stanford University and Columbia University established ‘climate schools.’ On technologies – between 2020 and 2023, $100 billion was deployed in early-stage climate tech across 130+ new climate funds.